Descending Triangle Pattern – Overview, Breakout, and Chart

- by GTF

When talking about trading, technical analysis plays an instrumental role in identifying trends and patterns in the price movements of stocks. In technical analysis, chart patterns are among the most commonly studied.

As far as chart patterns are concerned, the descending triangle pattern is tremendously effective. The fact that its success rate is almost 73% easily solidifies the statement.

So, how is the descending triangle chart pattern crucial in stock trading, and what must you know to mint profits through them? Let’s explore.

What Is a Descending Triangle?

A descending triangle chart pattern is a bearish pattern that traders and analysts use in price action trading. Also called a falling triangle pattern, this pattern helps traders identify potential trend reversals or the continuation of a downtrend.

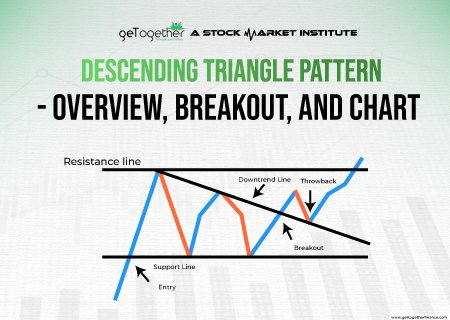

A descending triangle pattern is formed by drawing a horizontal line that connects a series of relatively equal lows, creating a support level. Simultaneously, a trendline is drawn connecting a sequence of lower highs, forming a descending upper trendline.

The convergence of these two trendlines creates a triangular shape, hence the name “Descending Triangle.” The support does not keep the stock price from moving downward. The lower highs indicate rising selling pressure.

Traders interpret the descending triangle pattern as a sign of weakening bullish momentum. Additionally, a potential breakdown below the support level signals a bearish breakout, prompting them to sell or take short positions. The pattern completes itself when the stock price breaks out of the support level and continues to fall.

The descending triangle chart pattern can appear at any time. For instance, the triangles are present on a daily chart for more than a week or several months, although you can spot them on an hourly chart for only a few days.

Characteristics of a Descending Triangle

Because of its shape, a descending triangle pattern is known as a right-angle triangle. Here are the key characteristics of the chart pattern:

Downtrend

Descending triangles appear in a downtrend, signaling a potential continuation of the existing bearish trend. However, they can also be reversal patterns if they form after a prolonged downtrend.

Lower Horizontal Line

At least two reaction lows form the lower flat line. The lows are not necessarily identical but stay within a reasonable proximity. Moreover, they have some distance and a high reaction between them. The lower trendline serves as support. The stock price often reaches this level and bounces off until the breakout eventually happens.

Upper Descending Trend Line

At least two reaction highs form the upper descending trendline. These reaction highs, or declining peaks, are successively lower and maintain some distance between them. This downward-sloping trendline indicates that sellers are slowly pulling the stock price down – offering further support for a bearish trading bias.

Breakout

The direction of the stock price movement after the triangle breaks out is critical. The descending triangle pattern is considered complete when the price breaks below the horizontal support line. A rise in volume accompanies this breakout and triggers bearish momentum.

Volume

Traders observe trading volume to confirm the descending triangle pattern. As the chart pattern develops, volume generally contracts. Increasing trading volume during the breakout, especially on a downward break, strengthens the anticipated stock price movement.

Setting Targets

Once the breakout has occurred, traders use the triangle’s height at its widest point to predict a price target for the next move. This projection helps in setting realistic expectations for potential profits.

Trading a Descending Triangle

Smart execution is key to optimal profits. Here are the five effective ways to trade with the descending triangle pattern.

Descending Triangle Pattern Breakout

The descending triangle pattern breakout strategy is all about predicting when a stock will break out of a descending triangle pattern. You have to start with choosing a stock that has been in a downtrend.

Here, you have to look for lower highs and lower lows getting formed. Then, chart the descending triangle pattern once you identify the price action.

You can see that the trade volume starts to reduce toward the end of the descending triangle pattern formation. Volumes are generally lower closer to the breakout.

Once you identify the lower trade volume, you must measure the distance from the first high to the low. Then, project the same from the breakout area, which becomes your target price.

Descending Triangle with Moving Averages

Moving averages (MA) are among the oldest and simplest of technical indicators. In this strategy, you use the descending triangle pattern to predict potential breakouts. Along those lines, the MA indicators give the signal to begin stock trading.

Look for lower highs connecting to a downward trendline and equal lows forming a horizontal base. Traders use MA indicators, such as the 20-day and 50-day MAs. If the stock’s price bursts through the triangle’s lower trendline and the 20-day average crosses below the 50-day average (death cross), it confirms the bearish signal.

Enter a short position (sell) near this breakout point for a potential price target based on the triangle’s height.

Descending Triangle Reversal Pattern (Top)

You can identify the descending triangle reversal pattern at a rally’s peak. This chart pattern occurs as the volume declines and the stock fails to make new highs. Additionally, it indicates a shift from bullish to bearish. The stock price peaks, forming lower highs while bouncing off the horizontal support.

A clear break below the support level with increased selling volume strengthens the bearish signal. Enter a short position at the breakout point or slightly below. Set your profit target based on the triangle’s height (measured from peak to support) projected downwards. Place a stop-loss above the breakout point to limit potential losses.

Descending Triangle Reversal Pattern (Bottom)

This descending triangle reversal paints a bearish picture but with a twist at the bottom. This potential reversal pattern offers a bullish opportunity.

Here, the stock price stalls after a downtrend, bouncing off a horizontal support marked by multiple lows. While lower highs form, the price refuses to break below the support level.

Look for lower highs and a defined horizontal support near a downtrend’s bottom. If the price decisively breaks above the upper trendline, enter long positions. Project the triangle’s height from the breakout point to set a profit target. Place a stop loss below the support level to manage risk.

Advantages and Limitations of the Descending Triangle Pattern

The descending triangle chart pattern offers the following benefits:

- Clear Bearish Signal: The pattern’s distinct shape, with a descending upper trendline and a horizontal support line, provides a crystal-clear visual indication of potential bearish market sentiment.

- Accurate Entry and Exit Points: You can use the breakout below the support line as an objective entry point for short positions. Similarly, upon a downward breakout, you can project a potential stock price decline by measuring the triangle’s height at its widest point and subtracting that value from the breakout point.

- Relevant Across Timeframes: You can spot the descending triangle pattern on multiple timeframes, from intraday charts to longer-term charts. Hence, the chart pattern provides flexibility for stock traders with different trading approaches.

- Technical Confirmation: When complemented by other technical indicators or chart patterns, the descending triangle can be a strong confirmation signal, boosting confidence in the anticipated price direction.

- Risk-Reward Ratio: You can analyze and manage risk effectively by setting stop-loss orders right above the breakout point. That way, you can experience favorable risk-reward ratios.

Like other chart patterns and technical indicators, the descending triangle chart pattern offers has a few drawbacks, including:

- False Breakouts: A stock price might initially break below the lower trendline, signaling a bearish move, but then quickly reverse within the triangle. This results in losses if traders act prematurely.

- Subjectivity: Economic events, news releases, or geopolitical factors can override the pattern’s signals, triggering unexpected price movements that invalidate the descending triangle pattern’s predictive power. Moreover, drawing trendlines accurately is subjective, leading to varying interpretations of the pattern’s formation and potential breakouts.

- Sideways Movement: Instead of a clear breakout, the stock price might move sideways within the descending triangle pattern for a long time, making it challenging for traders to determine a profitable trading direction.

- Upward Breakouts: While less frequent, upward breakouts do occur, defying the predicted bearish signal. As such, you have to consider other technical indicators and market contexts.

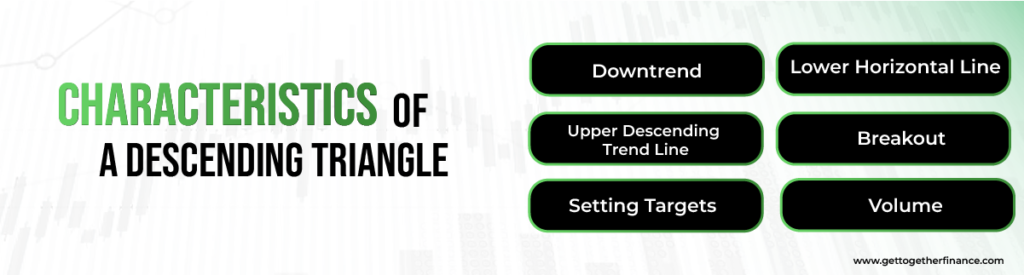

Descending Triangles vs. Ascending Triangles

Ascending and descending triangle patterns are two distinct chart patterns in technical analysis, each providing valuable insights into potential market trends.

Continuation Pattern

Descending triangles occur within a downtrend, signaling a potential continuation of the existing bearish trend. Conversely, ascending triangles occur within an uptrend, signaling a potential continuation of the existing bullish trend.

Formation

The descending triangle pattern is characterized by a horizontal support line and a descending trendline. The price forms lower highs, creating a triangle shape with a flat support line.

On the flip side, the ascending triangle pattern is characterized by a horizontal resistance line and an ascending trendline. The price forms higher lows, creating a triangle shape with a flat resistance line.

Trading Bias

The descending upper trendline reflects a bearish bias, indicating that sellers are consistently entering at lower stock prices. The ascending lower trendline reflects a bullish bias, indicating that buyers are consistently entering at higher stock prices.

Volume

During the formation of the descending triangle pattern, there is a decline in stock trading volume. A breakout below the support line is accompanied by a volume upsurge, confirming the potential bearish continuation.

Ascending triangles, too, experience lowered trading volume during the pattern formation. A breakout above the resistance line is accompanied by a rise in volume, confirming the potential bullish continuation.

Target Price

Traders can measure the height of the descending triangle at its widest point and project that distance downward from the breakout point to anticipate a potential target for the downward move.

Traders can measure the height of the ascending triangle at its widest point and project that distance upward from the breakout point to predict a potential target for the upward move.

Descending Triangle Measuring Technique

Measuring the descending triangle chart pattern involves estimating a potential price target for the downward move following the pattern’s breakout. Follow this step-by-step guide:

Identify the Pattern

Confirm the presence of a descending triangle pattern on the stock price chart, characterized by a horizontal support line and a descending upper trendline.

Measure the Pattern Height

Calculate the vertical distance between the highest point of the triangle (peak of the descending trendline) and the horizontal support line. This represents the pattern height.

Project Downward

Apply the pattern height to the breakout point. Once the stock price breaks below the horizontal support line, project the measured distance downward from the breakout point.

Target Calculation

Use the following formula for the projected target price:

Target Price = Breakout Price – Pattern Height

Where:

- Target Price is the estimated price target for the downward move.

- Breakout Price is the price at which the stock breaks below the horizontal support line.

- Pattern Height is the measured distance between the highest point of the triangle and the horizontal support line.

En Route to Profitable Trading

The descending triangle chart pattern, with its downward slope and shrinking price action, is a powerful bearish signal for traders. While breakouts offer directional clues, remember that the pattern is not a crystal ball. It is a technical indicator whose accuracy depends on various factors, including market context, and confirmation through other technical tools.

As such, always factor in broader market sentiments and implement risk management mechanisms to sail through uncharted financial territories. A cautious, informed approach can turn the descending triangle pattern into a profitable trading opportunity.

FAQ

What is a descending triangle in stock charts?

A descending triangle pattern is a bearish pattern that occurs when a stock’s price keeps hitting lower highs and flat lows, forming a triangle shape that narrows downwards. This suggests weakening buying pressure and a potential price drop.

How to identify a descending triangle on a chart?

First, identify and connect a series of lower highs. Then, spot a horizontal support line connecting at least two low points, forming the bottom side of the triangle.

How is the breakout from a descending triangle interpreted?

You can interpret the breakout from a descending triangle with these steps:

A decisive price move below the lower trendline of the triangle indicates a bearish signal. Use this as an opportunity to short the stock, expecting a further price decline.

Confirm the trend with increased trading volume.

Use the triangle’s height from the breakout point to estimate a price target.

What factors contribute to descending triangle formation?

These factors contribute to the formation of the descending triangle pattern:

Prevailing bearish market sentiment.

Sellers become more active, pushing the stock’s price downwards. This creates the lower swing lows that form the bottom of the triangle.

Buyers lose interest as the price declines, thus forming the lower swing highs that create the descending trendline.

What are some examples of successful trades with descending triangles?

Here are some popular examples of successful trades with descending triangles:

In January 2023, a descending triangle formed in Infosys’ stock price, with the price testing both trendlines multiple times. The price eventually broke below the support line with increased volume, confirming the bearish signal.

In August 2023, a descending triangle formed in Tata Motors’ stock price, suggesting a potential downside breakout. The price eventually broke below the support line with increased volume, confirming the bearish signal.

Traders who went short in both these instances benefited from the price decline in the following days.