What is the Difference Between Long-Term And Short-Term Trading ?

There are many different ways to trade in the financial markets, each designed to meet the needs and goals of different investors. Short-term and long-term trading are two common strategies used by investors. Investors trying to navigate the complicated trading world need to be aware of the differences between these approaches. We will examine the differences between long-term and short-term trading, as well as their characteristics, advantages, disadvantages, and considerations when selecting a trading style, in this blog.

Understanding LONG-TERM trading:

Holding positions in the stock market for an extended period of time i.e. typically several months to years is known as long-term trading. Long-term traders aim to profit from an asset’s gradual increase in value by capturing its overall trend. This approach lines up with investors who focus on basic investigation, looking for resources with solid development potential and worth.

Investment decisions in long-term trading frequently are based on extensive research, fundamental analysis, and economic factors. Understanding that short-term volatility may not have a significant impact on the overall trajectory of their chosen assets, they typically have a higher risk tolerance.

Buy-and-hold investing, dividend investing, and value investing are some well-liked long-term trading strategies. In buy-and-hold investing, fundamentally sound assets are chosen and held for a significant amount of time to allow their value to rise.

Understanding SHORT-TERM trading:

In contrast to long-term trading, short-term trading involves buying and selling financial assets in a relatively short period of time, which can be as short as a single day or as long as a few weeks. Short-term traders intend to benefit from the unpredictability and cost changes happening inside these and they depend intensely on specialized research, technical analysis, and market trends to pursue their investment choices.

Short-term trading requires a more dynamic methodology, as dealers intently screen market developments and execute trades in light of daily price action. The objective is to profit from short-term market fluctuations, also known as scalping or day trading, by repeatedly making small profits.

Scalping, momentum trading, and swing trading are all common short-term trading strategies. Scalping involves making quick trades to take advantage of small price changes with the intention of making a profit from many transactions. Momentum trading centers around distinguishing resources with solid cost force, expecting to ride the pattern for momentary increases. Swing trading is the practice of profiting from upward and downward price movements by taking advantage of short-term price swings within a larger trend.

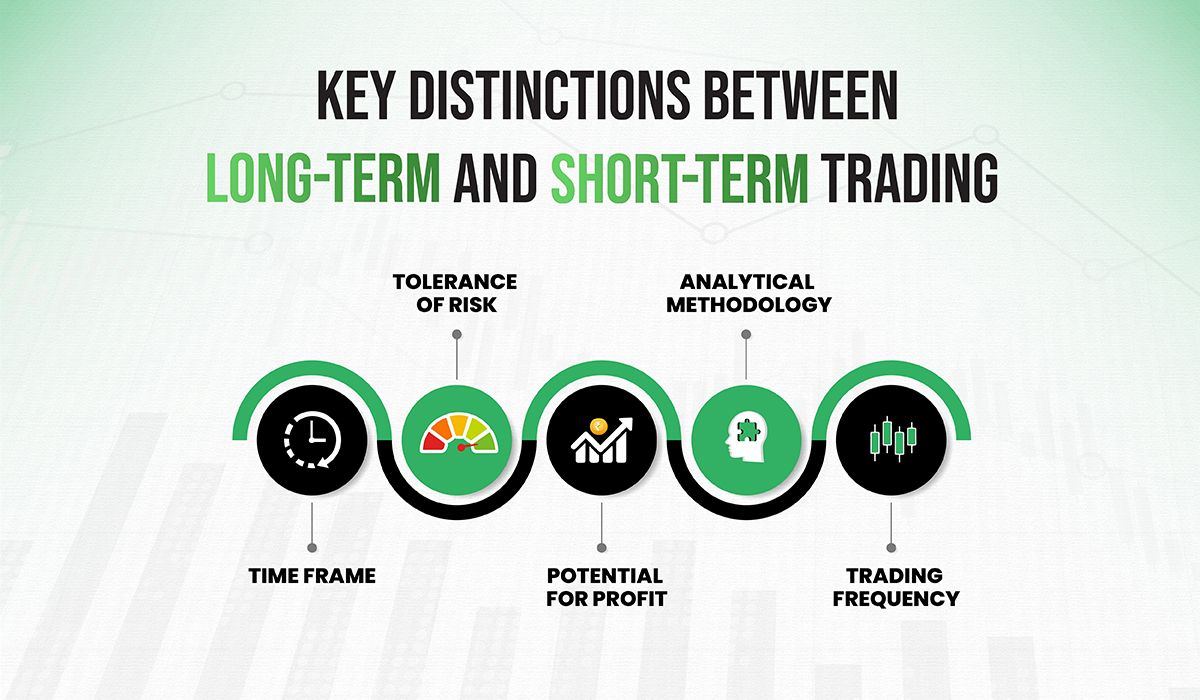

Key Distinctions between LONG-TERM and SHORT-TERM trading:

It is essential for traders to comprehend the key distinctions between long-term and short-term trading in order to select the strategy that best suits their financial objectives, risk tolerance, and trading preferences. Differentiating factors include:

Time-frame:

The essential qualification lies in the investment time span. Short-term trading involves much shorter holding periods, ranging from days to weeks, whereas long-term trading involves holding positions for months to years.

Tolerance of risks:

Long-term traders are those who are willing to endure short-term market fluctuations in the target of long-term growth, long-term traders typically have a lower risk tolerance. Short-term traders, on the other hand, use strategies that take advantage of short-term price movements to manage risk more actively.

Potential for profit:

The goal of long-term trading is to capture an asset’s overall growth and appreciation over a long period of time. While focusing on smaller price changes, short-term trading offers the potential for more frequent and immediate profits.

Analytical methodology:

Long-term trading heavily relies on fundamental analysis, economic indicators, and a thorough evaluation of a company’s prospects. Short-term trading places greater emphasis on technical analysis, price action, and market trends.

Trading frequency:

Since the emphasis is placed on maintaining positions for a longer period of time, long-term trading involves fewer transactions. Short-trading, conversely, requires more quick exchanging action, as dealers mean to catch numerous momentary benefits of opening doors.

Factors to consider while choosing your trading style:

There are several factors to consider when choosing a trading style:

Financial goals:

Think about your financial targets and adjust them to the trading style that best suits your objectives. Long-term trading might be more appropriate for investors looking for value enhancement over the long term, while short-term trading might be interesting to those searching for frequent gains.

Risk tolerance:

Assess your risk tolerance and determine how comfortable you are with short-term market fluctuations. Long-term trading is generally less affected by short-term fluctuations, whereas short-term trading requires active risk management.

Time responsibility:

Find out how much time you can spare for trading. Long-term trading calls for less time responsibility, including fewer trades and less tracking. More active participation and constant market observation are required for short-term trading.

Economic situations:

Take into account the current market conditions and volatility. Long-term trading can be stronger to financial market variances, while short-term trading depends on good economic situations with higher instability and cost developments.

Conclusion

The distinction between long-term trading and short-term trading lies essentially in the time period of investment, risk appetite, benefit potential, logical methodology, and trading frequency. There are advantages and disadvantages to both types of trading, and which one is best for you will depend on your financial objectives, tolerance for risk, commitment to time, and market conditions.

By figuring out the variations between long-term and short-term trading and taking into account the elements talked about, investors can pursue informed choices that can improve their trading experience and improve the probability of completing their financial targets.