Riding the Bull: Realizing Profits with Bullish Options Strategies

- by GTF

When the stock market is on an upswing, investors and traders often get overly enthusiastic. Their hyper-optimism pushes the market to new heights until it reaches saturation, where the trend reverses. In the dynamic realm of financial markets, where uncertainty often prevails, negotiating the complexities of options trading demands a strategic approach.

Among several trading strategies, the bullish options strategy stands as a beacon for investors/traders looking to cash in on the upward price movements. If you find yourself in the thick of a bullish rally, you must have bullish options strategies in place for optimal profits and minimal risk of loss due to rapid trend changes.

What are Bullish Options Strategies?

Bullish options strategies are trading techniques that investors use when they feel the price of a stock (s) will soar over time. It involves analyzing the stock’s support and resistance levels and picking the best possible strike price.

While some bullish options trading strategies help generate maximum returns, others are geared toward minimizing potential losses.

But why should you implement bullish options strategies? Because of the following reasons:

High return on investment

Unlike outright stock purchases, bullish options strategies demand less capital, making them more cost-efficient and highly profitable.

Limited risk

When you trade shares using bullish options strategies, the highest potential loss you bear is the premium you paid initially to buy/sell options contracts.

Flexibility in trading

You can choose contracts with various strike prices and expiration dates. So, you can tailor each bullish options trade to your specific market outlook and risk appetite.

Hedge investments

If you have an active long position on a stock and believe its share price will decline in the immediate future, you can purchase puts on that stock to hedge your position.

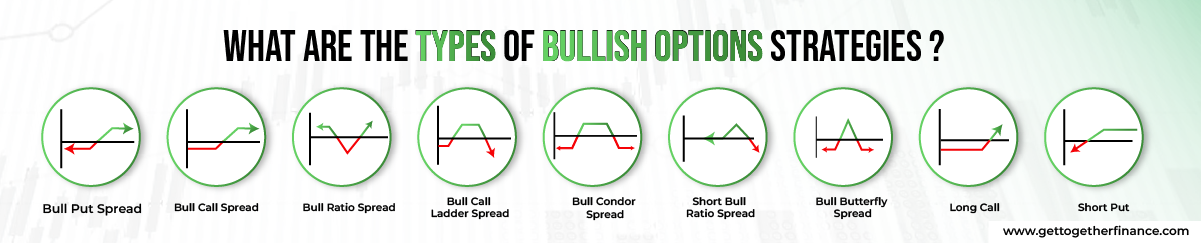

What are the Types of Bullish Options Strategies?

Let’s look at the various types of bullish option strategies:

Bull Put Spread

The bull put spread strategy involves buying put options with a higher strike price and selling put options with a lower strike price. The underlying stock and expiry date remain the same for both put option contracts.

For instance, a put option with a higher strike price enables traders to sell the underlying asset at a price higher than the current market price. These options are called “in-the-money” (ITM) as the asset’s market price is below the strike price during purchase.

Similarly, a put option with a lower strike price enabled traders to sell the underlying asset at a price lower than the current market price. These options are called “out-of-the-money” (OTM) as the asset’s market price exceeds the strike price during purchase.

Bull Call Spread

In the bull call spread strategy, investors purchase call options with a lower strike price while selling the exact number of call options with a higher strike price. Like the bull put spread, both call option contracts must be on the same stock and have the same expiry date.

For instance, a call option with a higher strike price enables traders to buy the underlying asset at a price higher than the current market price. These options are called “in-the-money” (ITM) as the asset’s market price is below the strike price during purchase.

Similarly, a call option with a lower strike price enabled traders to buy the underlying asset at a price lower than the current market price. These options are called “out-of-the-money” (OTM) as the asset’s market price exceeds the strike price during purchase.

Bull Ratio Spread

A bull ratio spread is an extension of a bull call spread. In this option trading strategy, investors purchase one at-the-money (ATM) call option and sell two out-of-the-money (OTM) calls. While the bull ratio spread is slightly more complex, it offers a high degree of flexibility.

Long Call

Buying a long call is the most bullish options trading strategy. The idea behind this strategy is to purchase a call option and exercise it (or sell it back) when the underlying stock price rises enough to produce a profit while only staking the premium you paid.

Short Put

The short put strategy involves selling a put options on a stock you are willing to hold at the strike price. You get a premium for writing the put option and must purchase the stock at the strike price if you exercise the option.

Short Bull Ratio Spread

Short bull ratio spread comprises two transactions. First, you purchase a specific number of call options of an underlying stock at a lower strike price. At the same time, you sell a greater quantity of call options on the same asset with a higher strike price. Both transactions have the same expiration date.

Bull Butterfly Spread

In a bull butterfly spread, traders combine four options contracts with the same expiry date at three strike prices. The bullish options strategy starts by purchasing two call options contracts of a stock – one at a higher strike price and the other at a lower strike price. Simultaneously, you must sell two call options contracts of the same stock at a strike price between the above range.

Bull Call Ladder Spread

A bull call ladder spread is a three-legged trading strategy implemented when stock markets are unlikely to move considerably higher. To execute this bullish options strategy, first, you need to purchase one in-the-money (ITM) call. Then, you need to sell two higher-strike ATM or OTM calls at different strike prices.

Bull Condor Spread

A bull condor spread is devised for traders who expect a moderate price movement in the stock. For proper execution, you must purchase a specific quantity of call options with a lower strike price while selling a different number of call options with a slightly higher strike price. Then, you purchase another set of put options with an even higher strike price and, eventually, sell a corresponding number of put options with the highest strike price.

Which are the Best Bullish Options Strategies?

Determining the “best” bullish options trading strategy depends on your goals, risk appetite, and market expectations.

Long calls offer simplicity, allowing investors to benefit from price increases directly. Bull call spreads, with limited risk and potentially enhanced returns, suit those seeking a structured approach. Bull put spreads provide a balance between risk and reward. Long call butterfly spreads and ratio call spreads are effective in specific market conditions.

The best bullish options strategy aligns with your individual preferences. So, evaluate each strategy’s mechanics and risk-reward profiles carefully.

How To Apply The Bullish Option Strategies

Implementing bullish options trading strategies involves a structured and disciplined approach. Here’s a general guide on how to apply bullish option strategies:

Market Analysis

Thoroughly analyze the market and the underlying stock. Assess factors such as volatility, current trends, and potential catalysts that can impact the stock’s price.

Choose a Bullish Strategy

Pick a bullish options strategy that aligns with your market outlook and risk tolerance. Common strategies include long call, bull call spread, covered call, and bull put spread.

Determine Strike Prices and Expiry Dates

Determine the strike prices and expiration dates for the bullish options trading contracts. Strike prices should reflect your expectations for the stock’s price movement, and expiration dates should align with your anticipated time frame for the bullish move.

Risk Management

Establish a clear understanding of the risks associated with the chosen strategy. Consider the potential maximum loss and profit, and ensure that the risk-reward profile lines up with your financial goals.

Closing in on Profit

All these bullish options strategies have their purpose. Each comes with its own risk-reward potential. It all relies on how deep your pockets are, how much risk you can handle, and how bullish you are on a particular stock.

Bullis options trading is not about winning big as much as it is about winning consistently over the long run. Hence, select the strategy with the lowest odds of failure instead of the one with the biggest potential payoff.

FAQs

How do I benefit from a bullish market with options?

To benefit from a bullish market with options, consider strategies like buying call options to capitalize on upward price movements. Alternatively, employ spread strategies like bull call spreads or bullish calendar spreads to manage risk and boost potential returns. These bullish options strategies provide leverage, helping you improve gains during a bullish market while limiting potential losses.

Can you explain the basics of a call option in a bullish strategy?

A call option in a bullish strategy is where an investor buys a call option, anticipating a rise in the underlying asset’s price. This strategy provides exposure to potential upward movements while reducing risk to the premium paid for the call option. The investor profits if the asset’s price increases and the risk is capped at the initial investment.

What are some popular bullish options strategies?

Popular bullish options strategies include the Long Call for straightforward upside exposure, the Bull Call Spread to manage costs, and the Covered Call for income generation. You can also consider the Bull Put Spread for stable or moderately rising markets and the Long Call Butterfly Spread for a defined risk-reward profile. These strategies offer diverse approaches to make the most of bullish market expectations.

When is the best time to use a bullish option strategy?

Bullish option trading strategies are best employed when anticipating upward stock price movements. Consider using them when market analysis suggests a bullish trend and factors such as positive economic indicators or corporate developments support this outlook. Additionally, these strategies are beneficial in stable markets or when a moderate, sustained increase in the stock’s price is expected.

What are the risks associated with bullish options strategies?

Bullish options strategies involve risks such as the potential loss of the entire premium paid, unfavorable market movements, and the risk of assignment. Market conditions may change, impacting the strategy’s effectiveness. Moreover, options have expiration dates, and if the stock’s price does not move as expected within the specified timeframe, the options may expire worthless, resulting in losses for investors.

How do I choose the right strike price for a bullish call option?

Choose a strike price that reflects a reasonable target for the stock’s upward movement. Consider historical price patterns, technical analysis, and market trends. Avoid excessively out-of-the-money options to ensure a higher probability of profit, while also accounting for the premium’s impact on the overall cost of the trade.

What is a covered call strategy in a bullish market?

In the covered call strategy, investors sell call options on a stock already held in their portfolios. This bullish options strategy generates income through the premium received from selling the calls while letting investors participate in potential upward price movements. If the market remains bullish, the investor keeps the premium, or else the existing asset provides downside protection.

What are some bullish options strategies for beginners?

For beginners, straightforward bullish options strategies include the Long Call, where you buy a call option to profit from upward price movement, and the Covered Call, where you sell a call option against stock you own for additional income. Bull Call Spread, a defined-risk strategy, combines buying and selling call options. These strategies offer a simple introduction to options while offering potential gains in a rising market with limited risk and complexity.

How do I manage a bullish options trade to maximize profits?

For maximum profits in bullish options trading, regularly examine the market’s momentum and your position’s performance. Adjust strike prices or expiry dates based on changing conditions. Implement trailing stops or take partial profits as the trade progresses. Stay vigilant for signs of trend reversals, and be flexible in your approach.