Demand and Supply Dynamics: Navigating Stock Markets Between Bull and Bear

- by GTF

We all have heard the buzz about demand and supply dynamics in the stock market – that place where money dances around like it’s at a party. Reading patterns in the market is like catching the rhythm of a song – it can tell you a lot, but it’s not always a straightforward dance. And hey, you’re spot on about breakout strategies – they’re like the surprise twists that keep the audience engaged. Before we join the fun, let’s break down one of the cool moves – demand and supply dynamics. But first, let’s overview some basics;

What is the Stock Market?

In very simple terms, the stock market is where the shares are bought and sold. Think of it as a place where people gather to trade ownership pieces of different companies. It’s like a never-ending auction, where everyone’s shouting, “I’ll buy this share for this much!” or “I’ll sell my share for that much!”

Let’s simplify it. Assume the stock market is like a giant playground for grown-ups, where you can play with money. Imagine you want to own a piece of your favorite pizza joint because you think they’re going to sell more pizzas and make more dough. Instead of buying the whole pizza joint, you buy a “share” of it. This means you’re a tiny owner, and when the pizza place makes money, you get a slice of the profits.

What is Demand and Supply

Let’s take a trip to this example before you understand the fundamentals. Imagine you’re at a party, and there’s a big bowl of your favorite chips. Everyone wants some because they’re so tasty – that’s the demand. Now, the host only bought a limited number of bags of chips – that’s supply. Wasn’t that easy? Let’s understand it more clearly:

- Demand: Demand is how much people want a particular thing. If it’s a super popular snack, like those chips, everyone will be reaching for them, right?

- Supply: Supply is how much of a thing is available. Think of it like the number of seats in a movie theater.

What is Demand and Supply in Stock Market

Demand and supply behaviour works for approximately every existing thing in the world. Think of the stock market like a big marketplace where people buy and sell shares of companies. Demand shows the willingness of buyers to purchase a stock, while supply is the availability of that stock for sale.

Demand: In layman’s terms, demand is how much people want to buy those stocks. It’s like when a new gadget comes out, and everyone is eager to get it – that’s high demand.

Supply: Supply is how many stocks are available to buy. If there are more stocks than buyers, it’s like having lots of toys in a store but not enough shoppers.

- When demand is high (lots of buyers), stock prices usually go up. It’s like when many people want the same toy, its price might rise.

- On the flip side, if supply is high (more stocks for sale), prices can go down. Just think of it as a store putting things on sale to clear out extra stock.

So, demand and supply work together to decide stock prices. If more people want to buy a stock than sell it, prices rise. If more people want to sell than buy, prices fall. It’s like a seesaw, always moving!

Laws of Supply and Demand Trading

For those who are wondering why it is important, the law of supply and demand is crucial for economists, investors, and entrepreneurs for predicting market conditions. These are the factors that determine the market price of things that are exchangeable. Low price increases demand and limits supply and high price can lead to rise in supply but drop in demand.

Law of Demand: The law of demand establishes the inverse relationship between the price and demand of a product. When prices drop, demand tends to increase. People love a good deal, and they’ll buy more if they can get stocks at lower prices.

Law of Supply: The law of supply explains the inter-relation between both product cost and supply quantity. When prices rise, supply tends to increase. Just like vendors produce more when the price of a popular item goes up, companies might issue more shares when prices rise.

Why is Demand and Supply Dynamic Important in the Stock Market?

Understanding demand and supply is like having a secret map or insider tip in the stock market. When everyone in the market is relying on conventional strategies, through this, you get out of the matrix and adept a new and better way to learn about market insights. Let’s break down the factors that impact demand:

Predicting the Winds: Forecasting Price Moves

Remember when the weather person accurately predicted a rainy day by calculating the wind direction, speed, and gloomy clouds? Understanding demand and supply in the stock market is like that – it gives you hints about where stock prices might head. Hence, you get a better look at the market charts when everyone is busy reading conventional patterns to figure out what’s going on.

Price Ballet: Impacts Stock Prices

When demand is high and supply is low, it’s like everyone’s screaming for the last piece of pizza at a party. Prices tend to shoot up. On the other hand, when supply is more than demand, it’s like too many pizzas and not enough hungry guests. Prices might take a dip. Now you know the trick!

Reading the Signs: Using Demand and Supply Insights

High demand and limited supply for a stock? It’s like a hot new gadget that everyone wants – prices could go up. And more supply than demand? Just like extra concert tickets, leading to decline in the prices. My last course – Trading in the Zone – Elementary, highlighted technical analysis of supply-demand dynamics. They stated that the basics of demand and supply dynamics go beyond the price prediction and market analysis; it’s like having an “insider” knowledge of the market. Isn’t it the best?

Making Informed Moves: The Key to Smart Trading

Yes! We understand the market is dynamic, but facts betray you less than the word. For instance, a farmer knows the value of fresh, locally grown strawberries. Hence, knowing these dynamics helps you anticipate price changes and make savvy trading decisions. It helps you understand more than what’s in the news, including fair dealings, risk management, market traps, trading psychology, advanced stock scanning techniques and more.

Making Your Moves Count: Leveraging Demand and Supply Understanding

Imagine playing chess – knowing your pieces and your opponent’s moves helps you strategize. Similarly, grasping demand and supply dynamics is your ace move in the stock market chessboard.

Your Secret Weapon: Riding the Demand and Supply Wave

Think of demand and supply as your financial radar – they give you a heads-up on price shifts. Just like checking the weather before heading out, understanding these dynamics can save you from surprises.

Beyond Numbers: The Human Element

Demand and supply dynamics aren’t just about charts and graphs – they’re about people’s decisions and emotions. It’s like knowing your best friend’s cravings before planning a surprise dinner.

Remember that understanding demand and supply is like having a secret decoder to translate the market’s language. It’s a skill that can make all the difference in your hunt for profitable trades.

Factors That Impacts Stock’s Demand and Supply

Ever wondered what makes the stock market swing like a pendulum? It’s a mix of various factors that play a symphony of price movements. Here are the key players:

- Company Performance: Just like a band’s performance affects ticket sales, how well a company is doing financially can impact demand and supply. If a company’s profits are soaring and it’s expanding, more investors might want a piece of the action – that’s higher demand.

- Economic Vibes: Imagine this – during a booming economy, people have more cash to invest. So, demand for stocks might rise. But when things get tough, like during a financial downturn, folks might tighten their belts and demand could drop.

- News and Gossip: But here’s the thing: while news can impact stock prices a lot, it’s not always reliable. Sometimes news can twist things. In the Trading in the Zone – Technical Analysis course, we stress on doing your market research. It’s like being your own investigator. Instead of blindly trusting news, it pushes you to rely on your own data. This way, you make decisions based on solid info, which helps you tackle the market with more confidence.

- Investor Sentiment: Think of this as the stock market’s mood. When investors are confident and optimistic, demand tends to rise. But if fear and uncertainty take over, demand might slip.

- Interest Rates: Interest rates have the power to sway how much people want to buy and sell stocks. It’s like the price you pay for borrowing money. In case of high interest rates, fewer people look forward to investing, leading to less flow of money and vice versa.

- Government Policies: Just as new rules change how a game is played, similarly,government policies can also impact stock demand. Favorable policies can boost demand, while unfavorable ones might lower it.

- Global Events: Like ripples in a pond, global events can affect stock demand. A major event, like a political shakeup, recession or a natural disaster, can cause investors to reassess their choices and influence demand. Just like the COVID-19 pandemic.

- Market Psychology: It’s like the mood in a crowded room. If everyone’s talking about a stock, demand can surge, even if there’s no concrete reason behind it.

Remember, demand and supply dynamics are like a complex dance – all these factors combine to create the rhythm of the stock market. Just like you’d check the weather before heading out, understanding these factors can help you gauge where the stock market winds might blow.

How Demand Affects Stock Prices

When more people want to buy a particular stock (high demand), its price usually goes up. This is because there are more buyers than sellers, and they’re willing to pay higher prices to secure the stock. It’s like a hot toy during the holiday season – everyone wants it, so its price shoots up.

Example: Let’s say Apple launches a super cool gadget. Now, here’s the twist: if they keep the supply limited, the demand stays high. That’s exactly what happens with stocks too. If a company measures how many shares they put out, the demand can surge, boosting the stock price.

How Supply Affects Stock Prices

On the flip side, when there are more sellers than buyers (low demand), the stock price tends to drop. This is because sellers might have to lower their prices to attract buyers. It’s like having a surplus of a product in a store – if they want to sell it quickly, they might put it on sale.

Example: Let’s say a pharma company faces a setback in its drug development. Investors get worried and start selling off their shares. With more people selling and fewer buying, the stock’s price takes a hit.

The Role of Equilibrium

The magic happens at the point where demand and supply meet – known as equilibrium price. This is where buyers and sellers have a friendly battle to drive the stock price in their favorable direction. Whosoever wins in this tug-of-war, pull the price toward its direction and that’s how the stock price moves up or down. Fascinating, isn’t it?

In a Nutshell

Alright, you’re not just dipping your toes – you’re diving into the stock market pool! Demand and supply are the dynamic dance partners of the stock market. Understanding how they interact can give you valuable insights into stock price movements. Remember: keep an eye on news, trends, and market sentiment to stay ahead of the game. So go on, make some savvy moves, and let the stock market adventure begin!

FAQs

Q: What are different trading strategies?

A: Think of these as secret handshakes in the stock market club. Trading strategies are like game plans that people use when buying and selling stuff in the financial world. They’re kinda like strategies in a video game – each one has its own approach to make money. Here are a few in simple terms:

1.Day Trading: Fast-paced trading within a day to catch small price changes.

2.Swing Trading: Holding onto assets for a few days or weeks to ride market trends.

3.Long-Term Investing: Holding onto investments for years to let them grow steadily.

4.Value Investing: Looking for undervalued assets to buy and hold until they rise in value.

5.Trend Following: Buying when the market goes up, selling when it goes down, following trends.

6.Arbitrage: Exploiting price differences between markets to make a profit.

7.Options Trading: Making bets on stock movements without actually buying the stocks.

8.Hedging: Making trades to protect against potential losses.

Remember, each strategy has its own unique approach to making money in the market, so it’s essential to pick the one that matches your goals and risk tolerance!

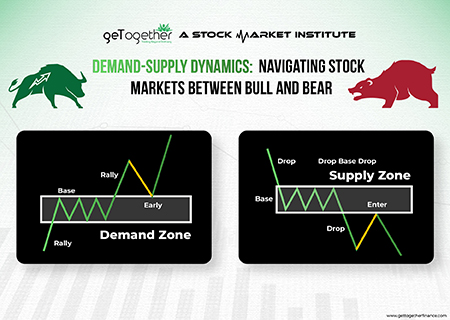

Q: What are demand and supply zones?

A: Imagine, demand and supply zones are like hotspots on a map of prices. Demand zones are spots where lots of folks want to buy stuff because it’s a good deal. Supply zones are where people are eager to sell because the price seems high. These zones are where the action happens in trading, where prices might change direction. It’s like finding the busiest corners in the market where buyers and sellers hang out!

Q: Can Demand and Supply Zones Change Over Time?

A: Absolutely! Think of demand and supply zones like cool hangout spots that people change their minds about. These zones aren’t set in stone – they can shift around as market vibes change. Just like you might prefer a different coffee shop one day, traders can see demand and supply zones change due to new info, trends, or even just mood swings in the market. So, what was a hot demand zone last week might become a chill supply zone this week. Staying flexible and aware of these changes can help traders keep their trading game on point!

If you want to level up your technical expertise on Demand and Supply Dynamics, Get a better look by clicking – Here